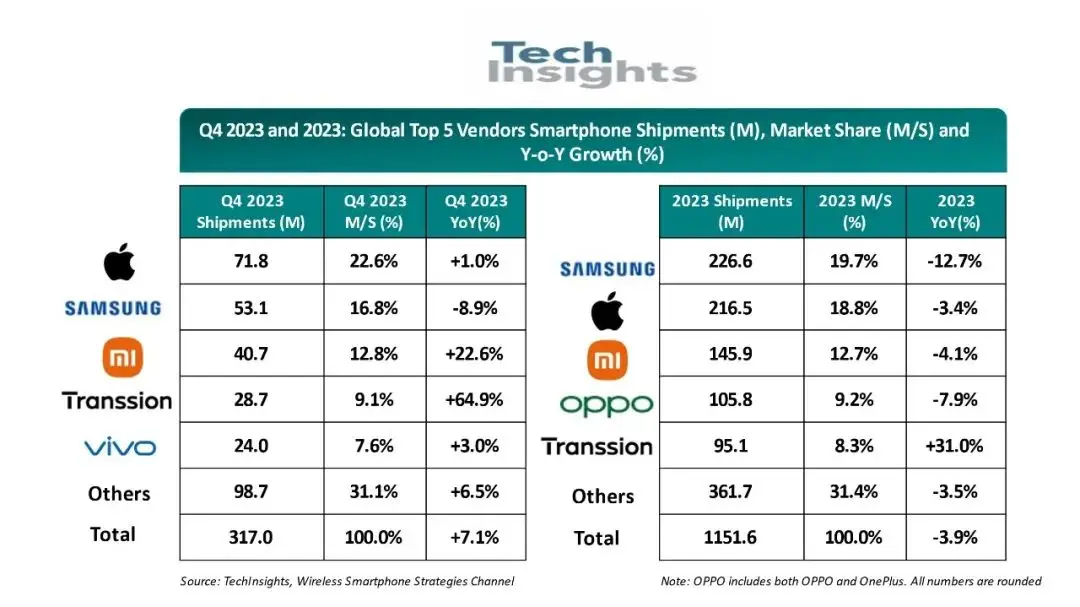

TechInsights' latest research shows that global smartphone shipments grew 7.1% year-on-year to 317 million units in the fourth quarter of 2023. Apple is in first place with 23% market share, followed by Samsung with 17% and Xiaomi with 13%. A significant proportion of the top 10 brands in the mobile phone market are now Chinese.

In 2023 as a whole, global smartphone shipments were 1.1516 billion units, a 3.9% annual decline. The market recovery was largely driven by normalisation of inventory levels, improving end-user demand and new product launch cycles by large companies such as Apple in the fourth quarter of 2023. India and other emerging markets performed strongly, which also drove the recovery. Chinese and North American markets are still at lows but have improved compared to previous quarters. Western Europe remains resilient, despite economic headwinds.

Apple

In the fourth quarter of 2023, Apple's global smartphone shipments were 71.8 million units, with a market share of 23%, up from 24% a year earlier. Apple iPhone shipments increased 1% year-on-year, in line with the same period last year. Apple's strong growth in Europe, India, Central and Latin America, and the Middle East largely offset mixed performance in the United States and China.

Samsung

Samsung came in second place with 53.1 million smartphone shipments. Although the company's smartphone shipments were down 9% year-on-year, its operating profitability was very solid thanks to tight cost control and operational efficiency.

Xiaomi

Xiaomi remained in third place with 40.7 million smartphone shipments, an annual increase of 23%. This gave it a 13% market share, 11% higher than a year ago. It is worth noting that the Chinese manufacturer has maintained its upward momentum for two consecutive quarters. The quarterly growth was largely driven by strong growth in India, Southeast Asia, Central and Latin America, Africa and the Middle East. For 2023 as a whole, Xiaomi smartphone shipments were 145.9 million units, with a 13% market share, matching the results achieved in 2022.

Transsion

Transsion (including the big three brands Tecno, Infinix and itel) rose to fourth place for the first time in Q4 2023. The Chinese brand is focused on markets in Africa, the Middle East, Asia, Central and Latin America, with a wide range of affordable smartphone models priced below $100 wholesale. Smartphone shipments of these three brands totalled 28.7 million units in the fourth quarter of 2023, representing 65% year-on-year growth, and their market share was 9%, up from 6% a year ago.

vivo

Vivo finished in fifth place. Its global smartphone shipments totalled 24 million units, a 3% year-on-year increase, representing eight consecutive quarters of decline. In India and Southeast Asian countries (Thailand, Philippines, etc.), healthcare needs are driving growth. In India, vivo has squeezed into the top three, with 13% annual growth in the quarter.

Huawei

It is also worth mentioning Huawei's market performance, although it has only achieved 3% of the large market pie globally, it has made significant progress in China.In Q4 2023, Huawei ranked ninth in the world, with smartphone shipments achieving double-digit annual growth rates (84% annual growth). Largely thanks to its resilience in the Chinese market. The 93% share of the Chinese market is mainly due to the iconic Mate 60 Pro. This quarter, Huawei has again entered the top five in the Chinese smartphone market.

Eight of the top ten brands in the world are Chinese. With the exception of OPPO (OnePlus), all other brands achieved year-on-year growth in Q4 2023. All these Chinese brands together achieved an annual growth of 18%, far outpacing the overall market growth of only 7%. This situation has improved further since last quarter (5% annual growth), signalling the end of inventory adjustments and improving end-user demand in India and other emerging markets where Chinese brands have strong growth momentum.

![[150] HyperOS heti hibajelentés](https://helloxiaomi.hu/wp-content/uploads/2024/04/hyperosbugreportindex-218x150.webp)