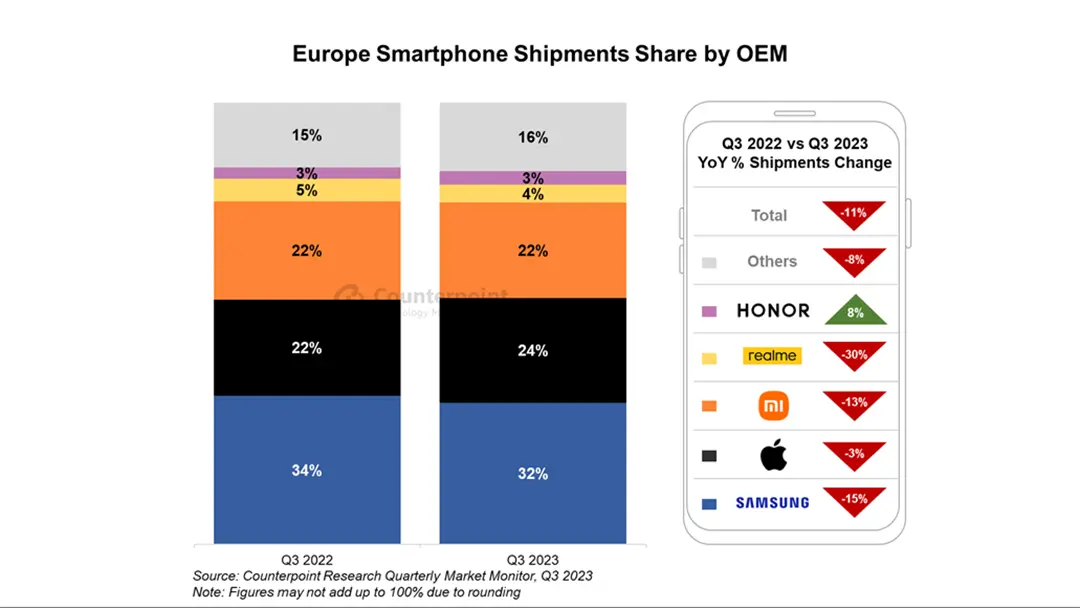

Q3 2023, the third quarterly report on the mobile phone market in Europe, is now available. The position of our favourite brands is unchanged, with Samsung first, Apple second, and Xiaomi third. But among the best-known brands, only Honor has made progress.

European smartphone shipments fell by 11% in the third quarter of 2023, according to the latest report from Counterpoint Research Market Monitor Service. Western Europe fell 8%, a slight rebound from the 14% decline in the previous quarter. However, Eastern Europe declined by 15% due to ongoing economic and geopolitical challenges.

Counterpoint Technology Market Research is a global research firm specializing in TMT (Technology, Media and Telecommunications) industry products. It serves large technology and financial firms with a mix of monthly reports, custom projects and in-depth analysis of the mobile and technology markets. Its main analysts are experienced experts in the high-tech industry.

Market summary for Q3 2023

- Samsung declined 15% YoY and reached its lowest Q3 shipments since 2011. The decline was mitigated by the launch of its new foldables, which received a warm reception in the region.

- Apple reached its highest Q3 share at 24% despite declining by 3% YoY and touching its lowest Q3 shipments since 2014. The OEM will likely lead in the coming quarter owing to pent-up upgrade demand for the iPhone 15 series.

- Xiaomi declined by 13% in Q3 2023 but remained the top player in Eastern Europe, capturing 35% of the market. The brand is also facing backlash in some Western European markets (like Finland) due to its continued presence in the Russian market.

- HONOR was the only brand among the top five to grow YoY, inching closer to levels before its split from Huawei and entering the top five. The brand is likely to take market share from other Chinese OEMs (like OPPO).

- Transsion brands TECNO and Infinix surged in the region, growing 192% and 518% respectively, with Russia being the primary market for both. In the coming quarters, the competition among the Chinese OEMs will intensify even as parallel imports sustain the market for Samsung and Apple.

- OPPO’s uncertainties in the region were reflected in its shipments, which declined 23% YoY. However, Eastern Europe limited the brand’s regional decline with 27% growth. In the coming quarters, the brand will likely face more issues in Western Europe.

![[150] HyperOS heti hibajelentés](https://helloxiaomi.hu/wp-content/uploads/2024/04/hyperosbugreportindex-218x150.webp)